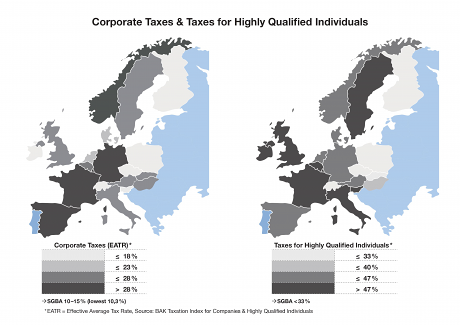

The most important indicator of the BAK Taxation Index for Companies measures the average tax burden or Effective Average Tax Rate (EATR) of a successful investment, taking into account all relevant tax types and regulations that apply at the respective location. The resulting tax rate is an important criterion for any profitable company evaluating a new location.

The most important indicator of the BAK Taxation Index for Highly Qualified Individuals measures the tax rate on the net income of 100’000 Euros for an unmarried, childless highly qualified employee, taking into account all relevant tax types and regulations that apply at the respective location, including non-wage costs and taxes for employer as well as employee. The resulting tax rate indicates the tax burden as a percentage of the gross income for a net income (i.e. after taxes) of 100'000 Euros. Just as the corporate tax rate, the tax rate on gross income of highly qualified individuals is a key cost factor for any company evaluating a new location.

Source: BAK Taxation Index

.jpg)

.png)